- 6/23/12: Social welfare ‘scam’: Two bank officials arrested Muzaffarnagar, India Jul 23 (PTI) Two officials of a public sector bank were arrested for their alleged involvement in a multi-crore Rupee scam in the Uttar Pradesh social welfare department, police said today. The bank’s branch manager Pramod Sharma and cashier Rajender Sharma were arrested yesterday in this connection, SP (City) Raj Kamal Yadav said. He also said that a hunt was on to nab Anil Verma, the main accused in the scam that took place during 2008-09. A former district welfare officer, Rinku Singh Rahi, had alleged a multi-crore scam in the social welfare department by staging a dharna in Lucknow seeking reply to an RTI query in connection with the “scam”. The Samajwadi Party government had ordered a probe into Rahi’s charges after coming to power in March this year.

- 6/25/12: Ex-SMBC Banker Arrested Amid Insider Trading Probe - Tokyo, A former SMBC Nikko Securities Inc. executive was arrested yesterday, becoming the first banker from a major Japanese brokerage to be detained for suspected insider trading since 2008. The Securities and Exchange Surveillance Commission and Yokohama city prosecutors are investigating former SMBC Nikko executive Hiroyoshi Yoshioka, 50, and three other people, the financial watchdog said in a statement.

- 6/25/12: Indonesia: Sumatran city of Medan ‘turning into terror financing centre’ – Jakarta, 25 June (AKI/Jakarta Post) – Indonesian officials said Medan, in North Sumatra, is turning into a centre for terrorism financing, following the arrest of five suspects with assets worth nearly Rp 8 billion (US$848,000), allegedly used to fund paramilitary training and terrorism operations. A suspect led police and armed anti-terrorism personnel to seize four houses, one shop, three cars and seven motorcycles in three locations that were purchased using funds the arrested suspects got from hacking a multi-level marketing website.The members bought the account numbers of bank clients in and outside the country. Some terrorist suspects posed as multi-level marketing members and sought more customers. “The hackers transferred the credit points to their accounts, and then sold them to brokers, who transferred the money equivalent to their bank accounts.”

- 6/26/12: The Shmuckler Group Owner Sentenced to 90 Months for Mortgage Rescue Fraud Scheme - (Source: FBI) - ALEXANDRIA, VA—Howard R. Shmuckler, 68, of Virginia Beach, Virginia, was sentenced today to 90 months in prison, followed by three years of supervised release, for running a fraudulent mortgage rescue business that received substantial fees but actually modified clients’ mortgages in only a few cases. “Mr. Shmuckler is a cunning criminal who took advantage of distressed homeowners in desperate need of help,” said U.S. Attorney MacBride.

- 6/26/12: MD Man Indicted in Over $9M Investment Scheme - (Source: FBI) - BALTIMORE—A federal grand jury returned an indictment today charging Larry Michael Parrish, age 48, of Walkersville, Maryland, with offenses arising from an investment scheme. According to the 25-count indictment, Parrish was the president of IV Capital Ltd., which he represented to be an investment and trading company. Parrish devised a scheme to obtain approximately $9.2 million from nearly 70 individuals who agreed to invest in IV Capital.

- 6/26/12: Research firm executive arrested on insider trading charges: FBI New York, (Reuters) – Law enforcement authorities said on Tuesday they arrested and charged an executive at an investment research firm as part of the government’s wide-ranging probe of insider trading at the now-defunct Galleon Group hedge fund. Tai Nguyen of research firm Insight Research LLC surrendered to the FBI Tuesday morning, an FBI spokesman said, and was expected to appear in federal court in Manhattan later in the day. Nguyen was facing charges related to insider trading, the FBI said, but the exact charges have not yet been made public. The FBI and federal prosecutors in Manhattan have mounted a campaign to root out insider trading on Wall Street, focusing in part on employees at so-called expert network firms who they say helped funnel corporate secrets from consultants at companies to hedge funds.

- 6/27/12: Former Loan Officer Clayton Coe From Failed FirstCity Bank Admits Guilty to Bank Fraud Scheme- WASHINGTON, DC – The Office of the Special Inspector General for the Troubled Asset Relief Program (SIGTARP) announced that Clayton A. Coe, 45, of McDonough, Georgia, the former Senior Commercial Loan Officer for FirstCity Bank of Stockbridge, Georgia, which failed and was seized by the FDIC, pleaded guilty yesterday to bank fraud. The plea is in connection with an $800,000 loan that Coe tricked FirstCity Bank’s Board of Directors into approving and from which he personally profited. He also pleaded guilty to filing a false federal income tax return with the IRS that omitted nearly a half million dollars of income from his job at the bank. ”Coe’s greed helped drive FirstCity Bank into the ground. He defrauded the bank to fund his ultimate payday and placed his interest in ill-gotten personal gain ahead of the interests of the bank, its customers, its investors, and the community the bank served. It’s precisely that sort of behavior that has robbed the public of its confidence in the banking industry and its institutions, and for his fraud, Coe will be banned for life from ever again practicing banking.”

- 6/27/12: Ponzi Schemer Scott Rothstein Knew Fraud Was Collapsing - (Source: Sun Sentinel, Fort Lauderdale, Fla — The letter sent Scott Rothstein into a panic, he feared his colossal crimes were about to be exposed. It was February 2009, eight months before his $1.4 billion Ponzi scheme collapsed. A family of investors had sent him the letter demanding their $4.25 million back immediately, and Rothstein was certain they had uncovered his secret. “Holy s***, this is going to explode,” Rothstein recalled thinking. “They figured out the Ponzi scheme. They know there’s no money in the accounts. We are all going to jail.”

- 6/27/12: Lenny Dykstra Agrees to Plea Deal in Bankruptcy Fraud Case - (Source: Los Angeles Times) - LOS ANGELES — Former baseball star and self-styled financial guru Lenny Dykstra, already sentenced to three years in a California state prison for a car scam, has agreed to a plea deal on federal bankruptcy fraud charges after looting his mansion of valuables as he struggled to battle numerous creditors. Dykstra, who helped the New York Mets win the 1986 World Series and later became a celebrity stock picker before his finances dissolved in chaos in 2009, has racked up a score of charges in recent years. His fall from grace during the last two years has resulted in conviction for a car finance scam and a separate charge of lewd conduct with a deadly weapon. Federal prosecutors entered under seal a plea agreement with Dykstra in connection with his embezzlement from the bankruptcy estate case.

- 6/27/12: A Stockbroker’s Undisclosed Arrest Sets Off A Regulatory Cavalcade Of Disaster - For the purpose of proposing a settlement of rule violations alleged by the Financial Industry Regulatory Authority (“FINRA”), without admitting or denying the findings, prior to a regulatory hearing, and without an adjudication of any issue, Bruce Parish Hutson submitted a Letter of Acceptance, Waiver and Consent (“AWC”), which FINRA accepted. The AWC alleges that on April 21, 2009, Hutson was arrested for retail theft based on allegations that he stole merchandise from a retail store in Wisconsin. Contrary to Firm policy, Hutson did not advise his member firm of the arrest.

- 6/27/12: Barclays to Pay More Than $450 Million in Interest-Rate Settlement - (Source: Los Angeles Times) – NEW YORK — Barclays Bank PLC has agreed to pay more than $450 million to settle charges it attempted to manipulate keyinterest rates. The London-based investment bank announced settlements with the U.S. Department of Justice, the U.S. Commodities Futures Trading Commission and the BritishFinancial Services Authority. Investigators found the bank manipulated the London InterBank Offered Rate, or LIBOR, and the Euro Interbank Offered Rate, or EURIBOR, benchmark interest rates used in the world’s financial markets.

- 6/28/12: Mortgage Scheme Nets Crofton Man a Prison Sentence - (Source: By Jamie Smith Hopkins, The Baltimore Sun - A Crofton man was sentenced Wednesday to more than four years in prison for redirecting about $5 million in mortgage payoffs on 17 Maryland properties to himself and a co-defendant, according to federal prosecutors. Todd R. Bettin, 42, was assistant manager of At Home Mortgage when he conspired with the owner of a Gambrills settlement company to illegally benefit from money intended to pay off clients’ mortgages.

- 6/27/12: Bidzina Ivanishvili’s banks and company arrested - Georgia, Tbilisi, National Bureau of Georgia continues performing the proceedings of the “Georgia Dream” coalition leader, Bidzina Ivanishvili. As told Trend in Bureau, gathering information was carried out on the property registered on billionaire. Executive Bureau requested the national Bank of Georgia, the identity of a beneficial owner of the banks “Kartu” and “Progress bank” and found that the owner of 100% stake in the bank “Kartu” is a “Kartu group”, and 21.7% shares of “Progress bank” – the owner of the beneficiary. Information provided by the National Bank of Georgia, found that, in accordance with the law on commercial banks face when buying a share of the bank is obliged to put in the prescribed manner notify the National Bank. In case of non compliance with this rule, the transaction for the sale of shares is not valid. Because the National Bank of Georgia was not represented by a declaration in order to change ownership of the beneficiary bank “Kartu”, the owner of 100% stake in the bank “Kartu” is still Bidzina Ivanishvili.

- 6/29/12: Karkala: Bank Manager Arrested for Fraud - Karkala, Jun 29: Suresh KP (29) who was working as a manager in Bhuvanendra branch of Syndicate bank was arrested on charges of misappropriating funds on Wednesday June 27 and was sent to Hiriyadka Jail. It is learnt that he opened fake accounts in fictitious names and created fake loans on them. He used to withdraw money from ATMs, committing a fraud of Rs 13.84 lac.

- 6/29/12: FBI says arrests Bernard Madoff’s brother - NEW YORK, June 29 (Reuters) – The FBI said on Friday it had arrested Peter Madoff, the younger brother of swindler Bernard Madoff, who is serving a 150-year prison sentence for his multibillion dollar Ponzi scheme. The arrest of Peter Madoff was expected as he is due in federal court in Manhattan later Friday to plead guilty to charges related to his brother’s decades-long fraud. Federal prosecutors on Wednesday revealed in a letter that Peter Madoff had been criminally charged with participating in his brother’s fraud. He is the first Madoff family member to be arrested and charged.

- 7/2/12: Catonsville RE Appraiser Pleads Guilty for Trying to Obtain $4.3M in Fraudulent Mortgage Loans - (Source: FBI) - BALTIMORE—Real estate appraiser David C. Christian, age 62, of Catonsville, Maryland pleaded guilty today to conspiracy to commit wire fraud. According to his guilty plea, Christian appraised a number of properties on behalf of purchasers who were seeking financing through a mortgage brokerage company. At the request of a co-conspirator who controlled the mortgage brokerage company, Christian prepared at least 17 fraudulent appraisals for $4,306,950 in loans originated at the mortgage company. Christian falsified the appraisals by using fake photos and descriptions of the properties, misrepresenting the condition of the properties, and used inappropriate comparable properties. The total loss for the 17 loans amounted to $2,661,366.

- 7/2/12: Four Defendants Indicted in Alleged $9.1M Mortgage Fraud Scheme - (Source: FBI) - CHICAGO—Four defendants, including a licensed realtor and two licensed loan originators, were indicted for allegedly participating in a scheme to fraudulently obtain at least 42 residential mortgage loans totaling approximately $9.1 million from various lenders, federal law enforcement officials announced today. The indictment alleges that the mortgages were obtained to finance the purchase of properties throughout Chicago by buyers who were fraudulently qualified for loans while the defendants allegedly profited. The lenders and their successors incurred losses totaling approximately $4.7 million because the mortgages were not fully recovered through subsequent sales or foreclosures. All four defendants were charged with various counts of bank fraud, mail fraud, and wire fraud in a five-count indictment that was returned by a federal grand jury last Thursday. The indictment also seeks forfeiture of at least $4.7 million.

- 7/2/12: Gary Foster: Former VP of Citigroup Sentenced to 97 Month in Prison for Embezzlement - (Source: FBI) — Gary Foster, a former vice president in Citigroup, Inc.’s treasury finance department, was sentenced to 97 months’ imprisonment today on a conviction for bank fraud arising from his embezzlement of more than $22 million from Citigroup. Foster embezzled by first transferring money to Citigroup’s cash account and then wiring it to his personal bank account at another bank. Foster used the money to buy real estate and luxury automobiles, including a Ferrari and a Maserati. In total, the value of the seized and restrained property is estimated to be approximately $14 million.

- 7/2/12: FTC Wins Multi Million Dollar Case Against Foreclosure Assistance Scam That Gave False Promises - (Source: FTC) — The Federal Trade Commission won a $2.6 million federal court judgment against three defendants behind a scheme that charged consumers large upfront fees and failed to deliver the mortgage modifications they promised. The FTC alleged that the defendants behind Crowder Law Group promised relief from burdensome mortgages by falsely claiming they could modify consumers’ mortgages and substantially reduce their monthly payments; exaggerating the role an attorney would play in obtaining a loan modification; and pretending to be affiliated with a government agency.

- 7/3/12: Mortgage Broker Gets Probation - (Source: The Pueblo Chieftain, Colo. – A Pueblo mortgage broker convicted in May of bilking at least $160,000 from a friend, was sentenced Monday to five years probation and may serve a 90-day jail term pending an appeal. Anthony Paglione, 61, was convicted for misappropriating money from Vincent Gagliano through a complicated series of loan swaps between two Pueblo homes. Paglione said the financial collapse the country has seen is one reason for what has happened.

- 7/4/12: Bank official threatens client, held - KOLKATA: A senior official of a private bank was has been arrested for allegedly sending threat mails to a city businessman. Sunil Bansali was rounded by police from Park Street on Monday night, police rounded from Park Street rounded up the bank official. Later, Bansali was produced in court and later released on bail. Sahni alleged that Bansali had demanded cut money to process the loan application, but Sahni turned him down. This made Bansali furious. He reportedly started harassing Sahni for money and later threatened to cancel the application.

- 7/5/12: U.S. Group: Lebanese Banks Laundering Money - (Source: The Daily Star, Beirut, Lebanon) — An anti-Iranian U.S. activist group is piling pressure on U.S. and European banks to dump their holding of Lebanese sovereign debt, describing Lebanon’s banking sector as a front for Iranian money laundering in cooperation with Hezbollah. “As a result of the actions and omissions of BDL [Lebanon's Central Bank] and the LBS [Lebanese banking system], Lebanon has become a sovereign money laundering jurisdiction that receives massive inflows of illicit deposits … from Hezbollah’s terror and criminal activities, and the illicit symbiotic relationships among Iran, Syria and Hezbollah,” said a press release issued Tuesday by the New York-based group United against Nuclear Iran. UANI argued that despite Lebanon’s “great risk of sovereign default” due to its high debt to GDP ratio, Lebanese sovereign bonds showed “irrational strength” that corresponds with increased pressure against Iran. UANI is also pushing to bar Lebanese financial institutions from participating in the U.S. financial system, urging the U.S. Treasury to designate Lebanon’s financial system as a “money laundering concern” under a statute of the Patriot Act.

- 7/5/12: Boxford Man Pleads Guilty to $6.9M Fraud Scheme - (Source: FBI) – ALEXANDRIA, VA—James W. Massaro, 70, of Boxford, Massachusetts, pled guilty today to engaging in a fraudulent foreign investment scheme that defrauded at least 20 victims of more than $6.9 million. Massaro pled guilty to one count of conspiracy to commit wire fraud. He faces a maximum penalty of 20 years in prison when he is sentenced on September 21, 2012.

- 7/5/12: Threat To Broker’s Client Assets Ends - The winding-up of a former Bahamian broker/dealer whose principal pled guilty in the US to money laundering is close to completion, its liquidator saying the Attorney-General’s withdrawal of a Forfeiture Order registration had eliminated a potential threat to client assets.

- 7/6/12: Prosecutors seek arrest warrant for Lee’s brother, ruling party lawmaker over bank scandal SEOUL, July 6 (Yonhap) — Prosecutors on Friday sought court warrants to arrest President Lee Myung-bak’s elder brother and a ruling party lawmaker for further questioning about their alleged involvement in a bank bribery scandal. Lee Sang-deuk, a 77-year-old former lawmaker of the ruling Saenuri Party, and Chung Doo-un, a legislator from the same party, were specifically charged with violating the law on political funds and peddling influence in exchange for accepting huge amounts of money from operators of two troubled savings banks. Prosecutors have found the chairmen of the banks extensively lobbied politicians and officials to avoid regulatory punishment. Despite these efforts, the two banks — Solomon Savings Bank and Mirae Savings Bank — had their businesses suspended earlier this year for lack of capital. The chairmen were later indicted on charges of extending illegal bank lending and conducting management irregularities.

- 7/6/2012: Ex-Bankas Snoras Owners Arrested Again in U.K. Over Fraud Claims - Bankas Snoras AB’s former owners were arrested again in London today on expanded claims they siphoned at least 1.7 billion litas ($609.5 million) from the failed Lithuanian lender to finance luxurious lifestyles. Russian banker Vladimir Antonov and his business partner Raimondas Baranauskas, who were detained in November and are fighting extradition to Lithuania, were arrested a second time after authorities probing the bank’s collapse in the Baltic country issued another European arrest warrant containing new allegations, John Hardy, a lawyer for the prosecution, said at a scheduled hearing today in London’s Westminster Magistrates Court.

- 7/6/12: Financial Adviser to be Tried Over the Theft of $2.2 Million - (Source: By The Honolulu Star-Advertiser (MCT) – A financial adviser accused of stealing $2.2 million from 22 active and retired city employees is scheduled to go on trial in state court next month for securities fraud and money laundering. Bruce M. Harada, 53, pleaded not guilty to the charges June 28. He remains in custody, unable to post $250,000 bail. He was an independent financial adviser for ING North America Corp., managing the deferred compensation accounts of active and retired city employees. Harada convinced at least 22 people to withdraw money from their deferred compensation accounts to reinvest in a mutual fund he said was authorized by ING. Instead Harada put it in his personal account and spent it for his own use, Van Marter said.

- 7/6/12: Fenton Man Pleads Guilty in $100-Million Mortgage Scheme - (Source:Detroit Free Press – A Fenton man pleaded guilty Thursday to running a massive mortgage fraud scheme that cost lenders more than $100 million in losses — some of which was used to buy cars, boats, trips and a helicopter for several con artists who were in on the scam, according to authorities. The U.S. Attorney’s Office said the ringleader, Ronnie E. Duke, 45, ran a nearly four-year scheme with eight others that involved more than 500 fraudulent mortgage loans, more than 100 straw buyers and roughly 180 residential properties in metro Detroit. The properties were used as, or falsely portrayed as, collateral for the loans, most of which went into default and foreclosure, authorities said.

- 7/6/12: FBI: Enumclaw finance adviser stole $2M, faked suicide - An Enumclaw financial planning adviser who allegedly left a fake suicide note in his car parked on Deception Pass has been arrested and charged with stealing at least $2 million from his clients, including one client whose death he also allegedly faked to collect the man’s life insurance. Aaron Travis Beaird, who worked as a financial planning adviser in Enumclaw, has been charged with wire fraud. The Federal Bureau of Investigation arrested him July 2 at SeaTac airport when he returned to Washington state from an undisclosed location.

- 7/7/12: Bank of India official arrested for bribery - Mumbai, July 7 — A senior official of the state-run Bank of India was nabbed red-handed while accepting a bribe of Rs.100,000, the Central Bureau of Investigation said here Saturday. Senior Manager Ganesh C. Das of the bank’s Mumbai main branch was trapped by CBI sleuths from the CST Station Friday evening taking the bribe from a financial consultant.

- 7/7/12: Judge: Bank fraud defendant to pay $712K - A federal judge has ordered a former Topeka bank vice president to pay more than $700,000 in restitution to the bank. Jennifer Hughes-Boyles, 40, of Topeka, Kansas pleaded guilty to bank fraud, a felony.

- 7/9/12: Enterprise Credit Union Employee in Dickinson County Pleads Guilty to Embezzling $85,000 - (Source: FBI) - TOPEKA, KS—A former employee of a credit union in Dickinson County has pleaded guilty to embezzling $85,000. Deborah A. Bomia, 46, Enterprise, Kansas, pleaded guilty to one count of embezzlement. In her plea, she admitted the crime occurred from April 30, 2005 to August 8, 2011, while she worked for Enterprise Credit Union in Enterprise, Kansas.

- 7/9/12: Johnson City Man Sentenced for Ponzi Investment Scheme That Lasted 15 Years - (Source: FBI) - Thomas E. Kelly, 64, of Johnson City, New York, was sentenced today in United States District Court to a term of imprisonment of four years and three months in connection with his previously entered plea of guilty to the felony crime of mail fraud. In addition, a term of five years’ supervised release, which will follow completion of Kelly’s prison sentence. Kelly was employed as a financial consultant by a number of banks located in the Binghamton, New York area. In his position as financial consultant, Kelly recommended that clients sell off legitimate securities investments in order to invest in a fictitious entity Kelly called Seneca Group. Kelly promised investors with Seneca Group a stable, secure investment. Instead, Kelly used money invested with Seneca Group to, make risky investments in the stock market and pay some of Kelly’s personal expenses. The amount of loss to investors as a result of Kelly’s scheme was almost one million dollars.

- 7/10/12: Dozens arrested in loan fraud scheme with victims in U.S, Canada - (Reuters) – Dozens of people were charged in what federal authorities on Tuesday called a highly sophisticated loan fraud scheme that robbed $2.7 million from at least 2,000 victims with poor credit histories in Canada and the United States. Would-be borrowers were lured to websites of 67 fictitious businesses with names similar to well-known lenders such as “Countrywide Funding,” which sounds similar to the legitimate Countrywide Financial Corp., and “Admiral Financial Services,” which mirrors Admiral Financial Corp., authorities said. They were approved for loans in exchange for security deposits ranging from a few hundred dollars to several thousand dollars – to be sent in advance of the flow of borrowed cash that never arrived.

- 7/10/12: Arlington Development Company Convicted in Mortgage Fraud Case - (Source: Dianna Hunt Fort Worth Star-Telegram, Texas (MCT) — An Arlington development company was convicted Monday and paid $50,000 in fines for participating in a complex $13 million mortgage fraud that operated throughout North Texas. In a rare criminal case against a corporation, Sierra Developers pleaded no contest to helping generate nearly $600,000 in fraudulent loans for the sale of two homes worth far less in Mansfield’s Twin Creeks subdivision in 2004.

- 7/11/12: Orange County Man Sentenced for Tax Evasion in Mortgage Fraud Conspiracy - (Source: FBI) - RIVERSIDE, CA—Today, Gregory Flores, former manager at All Fund Mortgage in Anaheim Hills, was sentenced to 144 months’ imprisonment and three years of supervised release. U.S. District Judge J. Virginia Phillips also ordered Gregory Flores to pay over $1 million in restitution to homeowner victims and over $98,000 in restitution to the IRS for his role in a mortgage fraud conspiracy and for evading taxes.

- 7/12/12: DOJ: Former Bank of the Commonwealth Executives Arrested for Alleged Fraud - Former executives and favored borrowers at the failed Bank of the Commonweath have been arrested and charged with masking nonperforming assets for their own benefit, in a scheme that contributed to the Virginia bank’s 2011 collapse, the Justice Department said.

- 7/12/12: Former bank manager pleads guilty to embezzlement - NEW ORLEANS (AP) – U.S. Attorney Jim Letten says a former manager of a Whitney Bank branch in Metairie has admitted stealing more than $56,000 from the bank. He says 50-year-old Karen Sork pleaded guilty Wednesday to bank theft, and could get up to 10 years in prison and $250,000 in fines, and restitution. Court documents say she was a banking officer and manager at the branch from December 2008 to August 2009, and sometimes acted as a teller. It says that when she did, she would regularly take cash from her “cash drawer,” put it into her personal accounts, and fill in a false amount of money on the balance sheet at the end of her shift.

- 7/13/12: Peregrine CEO arrested on fraud charges - WASHINGTON (MarketWatch) — Russell Wasendorf, the head of failed futures broker Peregrine Financial Group Inc., was arrested on Friday and charged with making false statements to the Commodity Futures Trading Commission. Wasendorf’s arrest comes after the CFTC filed a lawsuit against Iowa-based investment firm he oversaw, commonly known as PFGBest, alleging that the firm committed fraud by misappropriating roughly $215 million in customer funds. PFGBest filed for bankruptcy this week. The criminal complaint cites a seeming confession left by Wasendorf, who attempted to commit suicide on Monday. “I have committed fraud,” he said in a note referred to in the complaint. “Through a scheme of using false bank statements I have been able to embezzle millions of dollars from customer accounts” at the company. He added the scheme has been going on for nearly 20 years.

- 7/13/12: Former Hypo Bank Boss Arrested - Celje, 13 July (STA) – Božidar Špan, the former CEO of Austrian-owned Hypo Alpa Adria Bank, was detained Friday morning. Unofficial information indicates police are investigating the bank’s dealings with bankrupt builder Vegrad.

- 7/16/12: Nigeria: NCC Arrests Bank Manager Over Unregistered Internet Band - Akure — A manager with a first generation bank in Akure, Ondo State was, arrested by the National Communication Commission, NCC, over the use of unauthorised internet facility.The action of NCC officials resulted in long queue on the bank premises and at the ATM machines. The internet link being used by the bank was not licensed for it.”If the bank wants to use the link, it should approach NCC for licence instead of tapping into it without clearance from the Federal Government.”

- 7/16/12: Bank worker, customers arraigned for N10m fraud- A senior official of Diamond Bank Plc, Oludare Kazeem, and two customers of the bank have been arraigned before a Yaba Magistrate Court in Lagos for allegedly defrauding the bank of N10million. Kazeem was said to have aided Abike Awosika, 60, and Ademola James, 55, to steal the money from the bank. They were said to have committed the fraud when Kazeem assisted James and Awosika in procuring forged statement of accounts from Access and Skye banks with which the customers withdrew N4.5million and N3.5million from the Oregun branch.

- 7/16/12: Devon man arrested in alleged investment scam - RADNOR, Pennsylvania — A $150,000 investment into a business venture ended with a $198,000 loss for a Radnor couple and felony charges against their investment broker. Richard D. Jameison Jr., 42, is free on bail, charged with three felony counts of writing bad checks and one count of deceptive business practices, also a felony.

- 7/17/12: Bank teller charged over $250k fraud- A Sydney bank teller will face court next month charged with siphoning $250,000 from clients’ accounts. Police arrested the 39-year-old after investigations into an alleged fraud. Between October 2010 and January this year the woman, who worked for an inner-city bank, transferred the money into her own account. She has been charged with seven counts of dishonestly obtaining financial advantage by deception.

- 7/17/12: Two North County SD Loan Officers Admit Participating in Mortgage Fraud Scheme - (Source: FBI) – United States Attorney Laura E. Duffy announced that Simon Saeid Koli entered a guilty plea in federal court in San Diego today to count one of an indictment charging him and co-defendant Kian Ashkanizadeh with conspiracy to commit mail fraud, wire fraud, and money laundering in connection with a mortgage fraud scheme. Both defendants, who worked at a mortgage company called Southern California Finance, admitted that they recruited family members and friends to supply their names and signatures on mortgage loan applications. The defendants they then fabricated the job titles, income, and assets of the purported buyers, so they could qualify for approximately $1 million in mortgage funding on each of the properties. They diverted $200,000 in sham “consulting fees” and another $45,000 in fraudulent “construction fees” from each of the four transactions. The defendants took for themselves most of this extra $980,000 that they diverted from the escrow proceedings.

- 7/18/12: Former Star Bank Manager in Bertha Sentenced for Stealing $80K from Bank - (Source: FBI) - MINNEAPOLIS—Earlier today in federal court in St. Paul, the former vice president and branch manager of the Star Bank in Bertha, Minnesota, was sentenced for stealing $80,000 from the bank. United States District Court Judge Donovan W. Frank sentenced Kenneth Marlyn Ashbaugh, age 68, of Bertha, to five years of probation, along with 30 days in a county jail, six months of home confinement, and 500 hours of community service on one count of bank theft. In addition, Ashbaugh was ordered to pay more than $102,000 in restitution. Ashbaugh was charged on January 27, 2012, and pleaded guilty on March 5, 2012.

- 7/18/12: Man Behind Ponzi Scheme Gets 5 Years - ALBANY (Source: Times Union, Albany, N.Y. (MCT) — He took her money, her home and her credit. Now Arthur Strasnick is going to federal prison for five years — and his victim is dealing with the indefinite fallout from a financial “atrocity.” That’s what the woman told a federal judge Tuesday before Strasnick was sentenced for a nearly $2 million Ponzi scheme and mortgage scam. The 52-year-old victim said it left her in a financial nightmare and on the brink of suicide.

- 7/18/12: Bakersfield Family Indicted in Alleged Mortgage Fraud Scheme - (Source: The Bakersfield Californian (MCT) – The U.S. Department of Justice Tuesday unsealed a 26-count indictment against a Bakersfield family and their associates, accusing them of causing $5 million in lender losses in a years-long mortgage fraud scheme.Returned by a federal grand jury on Thursday, the 23-page indictment names Jara Brothers Investments Inc., or JBI, also known as Jara Brothers Development; and Pershing Partners, LLC, both property development companies.

- 7/18/12: LaRoque Indicted on Eight Counts of Theft, Unlawful Transactions Regarding Loan Business - (Source: The Free Press, Kinston, N.C. (MCT) – A federal grand jury has issued an eight-count indictment against Rep. Stephen LaRoque, R-Lenoir, for theft and misuse of funds from his small-business lending organizations. The office of Thomas G. Walker, U.S. Attorney for the Eastern District of North Carolina, issued a 72-page indictment Tuesday detailing the 15-year history of the East Carolina Development Company Inc. LaRoque founded the ECDC in 1997 to loan federal funds to people in Eastern North Carolina who want to start a business but have been turned down by private lenders.

- 7/18/12: Former Chief Financial Officer of Bixby Energy Systems Inc. Sentenced for Securities Fraud and Tax Evasion - (Source: FBI) - MINNEAPOLIS—Earlier today in federal court in St. Paul, the former acting chief financial officer for Bixby Energy Systems Inc. was sentenced for lying to investors to get them to commit large sums of money to the business and for failing to file federal tax returns and reporting his income for three years, which resulted in a tax loss for the Internal Revenue Service of $825,866.United States District Court Judge Susan Richard Nelson sentenced Dennis Luverne Desender, age 65, to 97 months on one count of securities fraud and one count of tax evasion. On September 14, 2011, Desender was charged and pleaded guilty to securities fraud. On February 23, 2011, he was charged and pleaded guilty to tax evasion.

- 7/18/12: Ex-UBS France Employee Charged in Tax Inquiry After Raids - A judge leading a tax-fraud investigation concerning UBS AG’s French unit has charged a second person with aiding in illicit marketing and money laundering. UBS avoided prosecution in the U.S. in 2009 by paying $780 million, admitting it helped thousands of Americans evade taxes and turning over the names of 250 American clients to authorities. UBS later revealed another 4,450 accounts held by clients in the country.

- 7/18/12: Exclusive: U.S. Insider Trading Investigation Winding Down - Edward Brogan was Japan’s highest-profile hedge fund manager until he suddenly dropped out of view this month.Dubbed the “King of Tokyo” by traders, the 53-year-old American seemed to have it all: wealth, professional acclaim and status as a patron of contemporary art.In his best year, Brogan had managed over one billion dollars in his flagship Whitney Japan Fund, although much of that has been withdrawn.

- 7/19/12: Stockbroker arrested as a serial window smasher - How do relieve stress if you are a broker with a top flight firm? Michael Steven Poret, 58, a broker at UBS Financial Services in Los Angeles, had an interesting method. He was arrested recently by the LAPD and accused of vandalizing “numerous businesses along Ventura Boulevard and several private homes in Beverly Hills,” according to the LATimes. ”A witness account and private surveillance footage have depicted the vandal as a graying man in white gloves firing marbles at plate glass windows with a slingshot from the driver’s seat of his car, then driving away in no apparent hurry. Authorities believe that Poret could be connected to more than 20 vandalism incidents in Beverly Hills and more than 50 in Encino, as well as several other vandalism reports authorities have received in Van Nuys and Topanga Canyon. The vandal appears to target businesses indiscriminately, hitting coffee shops, an autism treatment center and a salon.”

- 7/19/12: European report rips into Vatican bank for lack of oversight, transparency - A European report on Wednesday identified serious failings in the Vatican’s scandal-plagued bank, sharply criticizing its management and giving the Holy See a negative rating in almost half the most important transparency-related criteria. The Vatican said it saw the 241-page report as a constructive starting point that would allow it to improve its financial controls rather than as a conclusion. The report, by Moneyval, a department of the Council of Europe, was particularly pointed in its criticism of the management of the Vatican bank, officially known as the Institute for Works of Religion (IOR), and “strongly recommended” it be “independently supervised by a prudential supervisor in the near future.”

- 7/19/12: Hyderabad: Police arrest owner of investment company - Hyderabad, July 19 (PTI) City police today arrested V Ramesh, Managing Director of City Facility Management Services, for allegedly duping hundreds of investors by promising high returns and collecting deposits of Rs 43 crore. Investors approached the police after Ramesh became untraceable and office of the company was locked. Police have received complaints from about 1,800 investors so far. According to police, Ramesh had paid his investors around Rs 33 crore towards returns. The rest, he allegedly misappropriated. Some of the money was used for stock market trading. Personnel from Central Zone of Special Task Force arrested him and seized a four-wheeler, a laptop and a cash of Rs 40 lakh. Probe revealed that Ramesh, a commerce drop-out, had earlier been arrested in Kavali and Tirupathi in cases of theft and cheating some time ago. There was also a dowry harassment case pending against him, lodged by his wife.

- 7/19/12: Eleven Charged, Arrests Made In $15 Million Mortgage Fraud Scheme - CAMDEN, N.J. – Eleven individuals from five states are charged in New Jersey for their alleged roles in a $15 million mortgage fraud scam that used phony documents and “straw buyers” to make illegal profits on overbuilt condos, including a defendant who attempted to murder a witness to the scheme, New Jersey U.S. Attorney Paul J. Fishman announced.

- 7/20/12: Fulton County investment adviser arrested on securities fraud charges - WARFORDSBURG, Pennsylvania – Three years after the SEC first brought a civil suit against a Fulton County investment adviser, Robert G. Bard, has been arrested on securities fraud charges.Bard was indicted by the federal grand jury in Harrisburg, on Wednesday, in a 21-count Indictment charging one count of securities fraud, 14 counts of wire fraud, three counts of mail fraud, one count of bank fraud, one count of investment adviser fraud, and one count of making false statements to the FBI. Bard faces up to 20 years’ imprisonment on the securities fraud charge, up to 20 years’ imprisonment on the wire and mail fraud charges, up to 30 years’ imprisonment on the bank fraud charge, and up to five years’ imprisonment on the investment adviser fraud and false statements charge, as well as substantial fines and penalties if convicted.

- 7/20/12: Malaysia’s Securities Commission Spokeswoman: Sime Darby Director Arrested for Alleged Insider Trading - A director of Malaysian conglomerate Sime Darby Bhd. (4197.KU) has been arrested for alleged insider trading, a spokeswoman at the country’s Securities Commission said Friday.

- 7/20/12: Kumar Gets Probation for His Galleon Trial Cooperation - Crime doesn’t pay, but the lesson from insider-trader Anil Kumar’s case is that it pays to cooperate if you get caught. Kumar, 53, the former McKinsey & Co. partner, was facing 25 years in prison after pleading guilty to participating in an insider-trading scheme with Galleon Group LLC co-founder Raj Rajaratnam. Instead, he received a term of two years’ probation. U.S. Circuit Judge Denny Chin in Manhattan yesterday said he wouldn’t send Kumar to prison, and cited what prosecutors called Kumar’s “essential” and “extraordinary” cooperation as the first and key witness in the biggest insider-trading cases in U.S. history.

- 7/20/12: SJ Bank Manager, Husband Bilk Victim of $1.1 M- A JP Morgan Chase bank manager and her husband were convicted Thursday of scamming a 97-year-old man out of $1.1 million in life savings, according to the Santa Clara County District Attorney. Prosecutors said that bank manager Christina Bray, 30, befriended the elderly banking client and pretended to manage his financial affairs. Instead, prosecutors said, Bray and her husband, Jimmy Bray, 39, of San Jose, spent the victim’s money on luxury cars and liposuction. The couple pleaded guilty to several counts of felony elder theft.

- 7/20/12: UCO Bank manager, assistant held for fraud- NAGPUR: Kanhan police on Saturday arrested manager of UCO Bank, Gondegaon branch, for allegedly defrauding the bank of Rs1.52 crores. The assistant manager of the bank too has been arrested. The police are now looking for a private agent in the case. The manager, Anand Padikar (49) was produced before the court along with assistant manager Shrikant Joshi by the police on Saturday.

- 7/23/12: Suspect in underground bank network arrested - Shanghai police broke up an illegal banking network recently that involved 2 billion yuan ($314 million). The main suspect, identified only as Ge, 41, is accused of illegally making 2 million yuan in two years before he was detained. The underground banking network had more than 20 accounts in Shanghai and Zhejiang, Jiangsu and Guangdong provinces, according to investigators. In 2010, he is alleged to have developed an illegal foreign exchange network, China National Radio reported.

- 7/23/12: Former East Berlin Woman Gets Almost 20 Years for Fraud - (Source: Greg Gross The York Dispatch, Pa. (MCT) — A former East Berlin real-estate agent who defrauded mortgage lenders of more than $6.2million by filing false loan applications, then pocketed about $2.3 million of that money, was sentenced to nearly 20 years in prison. Joanne M. Seeley, 42, now of South Carolina, was sentenced Friday to 238 months in prison following a two-day sentencing hearing. Seeley was convicted in November of four counts each of wire fraud and money laundering.

- 7/23/12: Irish banker McAteer arrested by Anglo probe fraud squad officers - Willie McAteer is set to become the first banker prosecuted over the collapse of the toxic Anglo Irish Bank in 2008-2009. McAteer, an executive in the former rogue lender, is due in court in Ireland on fraud charges. Anglo’s former finance director was arrested this morning by fraud squad officers investigating financial irregularities at the bust bank.

- 7/23/12: Former Financial Services Executive Indicted for Participation in a Conspiracy and Scheme to Defraud Involving Investment Contracts - (Source: FBI)- WASHINGTON—A former financial services executive was indicted yesterday for his participation in a far-reaching conspiracy and scheme to defraud related to bidding for contracts for the investment of municipal bond proceeds and other municipal finance contracts, the Department of Justice announced. The indictment charges Phillip D. Murphy, a former executive for a financial institution, with participating in a wire fraud scheme and separate fraud conspiracies from as early as 1998 until 2006.

- 7/24/12: Anglo Irish Bank’s ex-CEO arrested for fraud - DUBLIN – Fraud detectives arrested the former chief executive of Anglo Irish Bank and charged him Tuesday over a conspiracy to hide colossal losses at the bank that brought the nation to the brink of bankruptcy. Forensic accountants found that Anglo provided secret loans to 16 insiders on condition they used the €1.1 billion ($1.35 billion) to buy Anglo stock.

- 7/24/12: Former HSBC Employee Falciani Arrested In Spain, Mediapart Says - Herve Falciani, a former software technician at HSBC Holdings Plc’s Swiss private bank who gave client data to a French prosecutor, was arrested in Spain, Mediapart reported in a summary of an article on its website, without saying where it got the information. Switzerland accuses Falciani of stealing data and breaching banking secrecy, according to the report.

- 7/24/12: Arrest of traders for rates manipulation imminent - US PROSECUTORS and European regulators are close to arresting individual traders and charging them with colluding to manipulate global benchmark interest rates, according to people familiar with a sweeping investigation into the rigging scandal. Federal prosecutors in Washington, DC, have recently contacted lawyers representing some of the suspects to notify them that criminal charges and arrests could be imminent, said two of those sources, who asked not to be identified because the investigation is ongoing.

- 7/24/12: Six Guilty in U.K. Insider-Trading Ring at Banks’ Printers - Spain and Italy reinstated a short- sale ban on stocks as bank shares plunged to record lows, bond yields rose and the euro traded below its lifetime average against the dollar on concern the debt crisis is growing. Spain’s CNMV market regulator banned the creation of negative bets on equities through shares, derivatives and over- the-counter instruments for three months. Italy’s Consob prohibited the practice on 29 banking and insurance stocks for one week, citing “grave tensions” in financial markets.

- 7/24/12 : Ex-Carlyle Consultant Seeks Probation For Insider Trading - Former A.T. Kearney Inc. partner Sherif Mityas asked to be sentenced to only probation for trading on information he learned as a consultant to the Carlyle Group (CG) about the private equity firm’s 2010 purchase of vitamin maker NBTY Inc. Mityas, who pleaded guilty in March to one count of securities fraud, filed a memorandum inBrooklyn, New York, federal court requesting that a judge impose a three-year term of probation. Federal guidelines point to a sentence of 10 to 16 months in prison, the filing said.

- 7/24/12: Local Securities Trader Indicted on Six Year/$2.5M Investment Fraud Scheme - (Source: FBI) - ST. LOUIS, MO—Grahame E. Rhodes was indicted involving an investment fraud scheme of approximately $2.5 million beginning in 1995 through 2011. According to the indictment, Rhodes was a self-employed futures securities trader who solicited clients/investors— mainly family members, neighbors, and friends—by promising them high rates of returns on their investments. The indictment alleges that despite his promises, his investments were minimal and earned little or no return of income. He returned some money to investors representing it to be profits, but it was actually money from new investors. Rhodes allegedly told them he had invested their money when he had not, and delayed requests for withdrawal of their money by creating false excuses to justify the delay. The indictment states that on many occasions he converted the money for his own personal use.

- 7/24/12: Former NY Employee of a Financial Institution Pleads Guilty for Role in Fraud Conspiracy - (Source: FBI) - WASHINGTON—A former financial institution employee pleaded guilty today for his participation in a conspiracy related to municipal bonds, the Department of Justice announced. According to the plea proceeding Alexander Wright, engaged in a fraud conspiracy in the municipal finance industry. The New York-based financial institution that employed Wright as a vice president of the municipal derivatives marketing group was a provider of investment agreements as well as other municipal finance contracts to public entities.

- 7/24/12: Ashburn Realtor Sentenced to 7 Years for $7M Mortgage Fraud Scheme- (Source: FBI) - ALEXANDRIA, VA—Nadin Samnang, 29, of Ashburn, Virginia, was sentenced today to 84 months in prison, followed by three years of supervised release, for orchestrating a mortgage fraud scheme that involved more than 25 homes in northern Virginia and over $7 million in losses to lenders. He was also ordered to pay restitution to the victim lenders and to forfeit to the United States nearly $1 million in proceeds of his unlawful conduct.

- 7/25/12: Former McGinn, Smith, & Co. Inc. CFO Pleads Guilty - (Source: FBI)- ALBANY, NY—The former chief financial officer for McGinn, Smith, & Co. Inc., Brian Shea, 53, of Niskayuna, New York, pled guilty today before United States District Court Judge David N. Hurd to one count of corruptly interfering with the administration of the internal revenue laws. Shea faces up to three years in prison and a $250,000 fine.

- 7/25/12: POLICE: Ex-Bank Manager Charged With Exploitation, Forgery in St. Charles - After a six-month-long investigation, a 56-year-old St. Charles woman was charged with financial exploitation of the elderly, forgery and felony theft, police said. Police arrested Lynn A. Pranga, St. Charles, after an investigation revealed the former branch manager of an MB Financial Bank violated a customer’s account by making unauthorized withdrawals of an account between 2009 and 2011. The investigation began Jan. 11 after an elderly MB Financial Bank customer reported to bank officials that his five-year certificate of deposit had been changed to a one-year CD and was worth far less than when it started out. Officials from the bank told the customer that records showed several withdrawals had been made from the account. He denied having made any withdrawals.

- 7/15/12: Mexico fines HSBC $28 million in money laundering investigation - MEXICO CITY — Mexican regulators have levied a $28 million fine against the Mexico subsidiary of London-based HSBC bank for failing to prevent money laundering through accounts at the bank.Mexico’s National Securities and Banking Commission said Wednesday that HSBC has paid the fines, equivalent to 379 million pesos, or about half of the subsidiary’s 2011 annual profits. The commission, and a report by a U.S. senate investigative committee, found the bank failed to control suspicious flows of billions of dollars through its accounts and didn’t respond promptly after being warned about a huge swell in dollar cash transactions at the bank.

- 7/25/12: 20 People Charged in Puerto Rico for Loan Application Fraud - (Source: FBI) – SAN JUAN—A grand jury returned a 45-count indictment charging 20 individuals with making false statements in loan applications, aggravated identity theft, and money laundering. According to the indictment, defendants Carlos D. Cuevas-Díaz, Miguel Ángel Echegaray-González, and Lee A. Arcia-Centeno conspired and agreed with each other, and with diverse other persons known and unknown to the grand jury, to knowingly make false statements or cause false statements to be made to mortgage lending institutions Equity Mortgage, Latin American, and Express Solution for the purpose of influencing the Federal Housing Administration (FHA) to insure the mortgage loans.

- 7/25/12: Throop Man Sent to Jail for Conducting Unlicensed Mortgage Business, Theft- (Source: The Times-Tribune, Scranton, Pa. – In the eyes of the clients he provided mortgages to over several months in 2009, Timothy Tanana was a helpful professional. But in the eyes of Lackawanna County Judge Vito P. Geroulo on Tuesday, the 43-year-old Throop man was simply a “con man.” When it came time for Mr. Tanana to speak for himself before receiving a sentence of 11 to 23½ months in Lackawanna County Prison for theft and conducting unlicensed mortgage business, he dwelled on his mounting bills and gambling addiction. Judge Geroulo, however, pointed out that Mr. Tanana appeared to be trying to “smooth” him just as he had the 17 clients he persuaded to pay a total of $53,137.58 to him in fees – while he was already making a $160,000 salary.

- 7/25/12: More Than 1,000 Bilked in Mortgage Modification Scam - (Source: The Press-Enterprise, Riverside, Calif. (MCT) — The operators of a boiler-room telemarketing company, US Homeowners Assistance, were ordered Tuesday, July 24, to pay more than $4 million in penalties for false mortgage modification loan promises made to more than 1,000 customers.

- 7/26/12: FL Title Agency Owner Sentenced for Mortgage Fraud Scheme - (Source: FBI) - JACKSONVILLE, FL—U.S. Attorney Robert E. O’Neill announces that U.S. District Judge Henry Lee Adams, Jr. today sentenced Cynthia Darlene Strickland (46, Jacksonville) to 18 months in federal prison for bank fraud related to a mortgage fraud scheme. As part of the sentence, the court ordered Strickland to pay restitution to victims in the amount of $531,356. The court also entered a judgment against Strickland for $178,625, which was the amount of money she received as a result of the scheme. Strickland pled guilty.

- 7/25/12: Capital One To Pay Millions After Being Charged With Improper Military Foreclosures - WASHINGTON — Capital One has agreed to pay $12 million to resolve allegations the bank violated special consumer protections in federal law for members of the military, the Justice Department announced. The government says Capital One wrongfully foreclosed on some homes and improperly repossessed some cars. In addition, the government says the bank obtained wrongful court judgments against some service members and improperly denied interest rate relief on some credit card and car loans. In a settlement under the Servicemembers Civil Relief Act, Capital One will pay $7 million in damages, including at least $125,000 to each service member whose home was unlawfully foreclosed upon and at least $10,000 to each service member whose vehicle was unlawfully repossessed. Capital One will provide a $5 million fund to compensate service members denied appropriate benefits on credit card accounts, auto and consumer loans.

- 7/26/12: 7 Defendants Indicted in Alleged $8.5M Mortgage Fraud Scheme Involving Multiple Lenders- (Source: FBI) - CHICAGO—Seven defendants, including two real estate investors and three licensed loan originators, were indicted today for allegedly participating in a scheme to fraudulently obtain more than 20 residential mortgage loans totaling approximately $8.5 million from various lenders. The indictment alleges that the mortgages were obtained to finance the purchase of properties by buyers who were fraudulently qualified for loans while the defendants allegedly profited. As a result, various lenders and their successors incurred losses because the mortgages were not fully recovered through subsequent sale or foreclosure. All seven defendants were charged with one or more counts of mail fraud and/or wire fraud in a 12-count indictment that was returned by a federal grand jury. The indictment also seeks forfeiture of at least $8.5 million.

- 7/26/12: Former Anglo Irish banking chiefs arrested - More high-ranking bankers, including Massachusetts-based former Anglo Irish Bank CEO David Drumm, could be included in later prosecutions in an investigation which started in February 2009.

- 7/27/2012: Michael Marin, Ex-Wall Street Trader, Took Cyanide After Guilty Arson Verdict - PHOENIX —

A former Wall Street trader who collapsed in court after being found guilty of arson and later died committed suicide by taking cyanide, according to an autopsy released Friday. The Maricopa County medical examiner’s office toxicology tests showed Michael Marin, 53, had the poison in his system. The report also noted an apparent suicide note emailed by Martin shortly before his death and cyanide found in his car afterward. After he was found guilty of arson in June, Marin put his head in his hands and appeared to put something in his mouth. He then drank from a sports bottle.

A former Wall Street trader who collapsed in court after being found guilty of arson and later died committed suicide by taking cyanide, according to an autopsy released Friday. The Maricopa County medical examiner’s office toxicology tests showed Michael Marin, 53, had the poison in his system. The report also noted an apparent suicide note emailed by Martin shortly before his death and cyanide found in his car afterward. After he was found guilty of arson in June, Marin put his head in his hands and appeared to put something in his mouth. He then drank from a sports bottle. - 7/27/12: Citibank’s Indonesian Scandal Deepens As Convicted Debt Collectors Go Missing - Irzen Octa, an Indonesian businessman, died in a Citibank office under mysterious circumstances last March, while debt collectors were questioning him about money he owed on a Citibank credit card. Now, two of the three collectors convicted in Octa’s death are reportedly on the run from the law. Arif Lukman and Henry Waslinton, who were each sentenced to five years in prison last month for their role in the March 2011 interrogation, have failed to answer a court summons for detention, according to theJakarta Globe. On Wednesday, both men were declared fugitives. Octa, who owed Citibank more than $11,000 at the time of his death, met with third-party collectors on March 28, 2011, in an attempt to negotiate a settlement. He was found dead in the Citibank office that afternoon. Post-mortem reports from various doctors have given his cause of death as asphyxiation, brain hemorrhage and “blunt violence,” according to The Washington. In the past, Citi customers in India have alleged that debt collectors working on behalf of the bank threatened to kill them or remove their organs if they did not pay. A Citi spokeswoman told reporters that these were “isolated cases.”

- 7/27/12: CBI arrests banker for Rs 50K bribe- India, PATNA: A CBI team on Thursday caught Samastipur-based Kshetriya Gramin Bank branch manager Shiv Kumar red-handed when he was entering the bank after accepting a bribe of Rs 50,000 from a complainant, Laxmi Sah, a resident of Samastipur.CBI SP B K Singh said a loan of Rs 4.30 lakh under the Pradhan Mantri Rojgar Yojana was sanctioned to Sah for setting up an oil mill. But the branch manager was demanding Rs 70,000 for withdrawal of the loan amount. Sah lodged a complaint with the CBI on July 23, he said.Singh said a CBI team verified the allegation and laid a trap on Thursday. The complainant reached the bank and the branch manager gave him Rs 1 lakh and came out of the bank with him. Kumar gave the complainant an envelope and asked him to put Rs 70,000 into it.

- 7/27/12:TD bank denies wrongdoing after court convicts U.S. fraudster in $7B Ponzi scheme- Robert Allen Stanford was the stereotype of a Texas tycoon, oozing the extravagance billions of dollars buys: a fleet of private jets, yachts and helicopters; mansions, castles and a private island; mixing with celebrities and world despots; being knighted and hosting a world sports tournament where he put up the US$20-million purse. At the height of his outsized life, however, his banking empire collapsed and, last month, a U.S. court exposed his US$7-billion fraud, sentencing the 63-year-old to 110 years in prison. Now, attention is turning to the role a respected Canadian bank may have played in allowing Stanford to strip 21,000 investors of their savings.

- 7/27/12: Virginia Mortgage Broker Pleads Guilty in $700,000 Fraud Scheme- (Source: FBI) - WASHINGTON—Donald M. Ramsey, 45, a mortgage broker from Alexandria, Virginia, pled guilty today to a charge of conspiracy to commit bank and mail fraud for his part in a scheme that cost lenders more than $700,000.

- 7/27/2012: Bankrupt Sean Quinn: I’m scared to go to prison but I won’t back out of it- BANKRUPT businessman Sean Quinn has said he is afraid to go to prison but he won’t back out of it. Last week, a High Court judge jailed the son and nephew of the disgraced businessman for three months after finding failures to adequately comply with court orders aimed at reversing measures stripping multi-million assets from the Quinn family’s international property group. Sean Quinn Junior is currently serving a three month sentence. Peter Darragh Quinn failed to turn up in court and a warrant has been issued for his arrest.

- 7/27/12: Barclays Execs Under Another Investigation AND BANK SET ASIDE HUNDREDS OF MILLIONS FOR MISSELLING DERIVATIVES - (NEWSER) – Barclays raised a whole bunch of eyebrows when it released its earnings today—and in the process revealed, among other things, that current and former senior executives were under an investigation totally unrelated to the Libor. UK regulators are looking into whether the bank sufficiently disclosed details of the $11.45 billion cash injection it got from Middle Eastern investors during the 2008 financial crisis, the Wall Street Journal reports. If that weren’t enough, the company also revealed that it had set aside $705 million to cover misspelling of derivatives to small businesses, and that it was facing a number of lawsuits over the Libor scandal. On the call, departing Chairman Marcus Agius apologized yet again for that mess, and said he was working to find his own replacement, along with one to fill the hole left by former CEO Robert Diamond. “It is tempting to find a quick solution,” he said. “It is important that the right selection is made.”

- 7/27/12: Foreclosure Prevention Business Owner Pleads Guilty in Major Mortgage Fraud Scheme - (Source: FBI) - WASHINGTON—Carline M. Charles, 41, who operated a business that supposedly would rescue distressed homeowners from foreclosure, pled guilty today to conspiracy to commit bank fraud for her role in a mortgage fraud scheme that cost lenders at least $1 million, announced U.S. Attorney Ronald C. Machen, Jr. and James W. McJunkin, Assistant Director in Charge of the FBI’s Washington Field Office.

- 7/27/12: CO Man Pleads Guilty to Scheming Investors Out of $7M for Personal Use- (Source: FBI) – MINNEAPOLIS—Earlier today in federal court, a 37-year-old Colorado man pleaded guilty to scheming investors out of $7 million. Evan Matthew Flaxman, of Silverthorne, Colorado, pleaded guilty to one count of mail fraud in connection to the scheme. Flaxman, who was charged on June 14, 2012, entered his plea before United States District Court Judge Patrick J. Schiltz.

- 7/27/12: Former Hedge Fund Manager Receives Over 6 Years in Prison for Being in Charge of Ponzi Scheme - (Source: FBI) – A hedge fund manager was sentenced today in Brooklyn federal court to serve 78 months in prison for running a Ponzi scheme. Ward Onsa, 60, of Naples, Florida, the manager of New Century Hedge Fund Partners LP, was sentenced by U.S. District Judge Dora L. Irizarry. Onsa pleaded guilty in December 2011 to operating the scheme, which resulted in losses to investors of over $3 million dollars. The court also ordered restitution to be paid to the defendant’s victims.

- 7/27/12: Man From Ohio Charged with Investor Fraud- (Source: FBI) — A resident of East Liverpool, Ohio, has been indicted by a federal grand jury in Pittsburgh on charges of wire fraud, United States Attorney David J. Hickton announced today. The defendant defrauded three investors by representing that he was a successful currency trader and obtaining $78,000 from them for this purpose and thereafter retaining and spending more than $49,000 for his own purposes, while earning no profits for investors and incurring more than $28,000 in currency trading loses. The law provides for a maximum total sentence at each count of 20 years in prison, a fine of $250,000, or both.

- 7/27/12: - SEC, FINRA Enforcement Roundup: $268M Insider Trading Scheme Busted - Charges of insider trading in a secondary stock offering, accounting violations, insider trading around an acquisition and efforts by a phony company president to push a fake penny-stock investment were among enforcement actions taken by the SEC, while FINRA censured and fined a firm for a registered representative’s unsuitable and excessive trading in client accounts.

- 7/27/12: Comsys CEO pal charged with insider trading - CHICAGO (MarketWatch) -The Securities and Exchange Commission said Wednesday that it has charged a friend of a CEO of a Houston-based employment services firm with insider trading for using confidential information he learned “while they were spending time together.” Accused is Ladislav “Larry” Schvacho, who the SEC charges illegally made $511,000 by using the information to trade around the 2010 acquisition of Comsys IT Partners Inc. by Manpower Inc. (US:MAN) They claim that he gleaned nonpublic information while Comsys CEO [Larry Enterline] “called other Comsys executives to discuss the acquisition and through confidential, merger-related documents to which Schvacho had access.” He then compiled a portfolio of 72,000 shares of Comsys in the weeks before the acquisition, the SEC said, using all available cash in his brokerage accounts to buy it. Schvacho then sold half of his Comsys shares as soon as the deal announcement was made.

- 7/27/12: Ipswich: Santander worker avoids jail over thefts from customer accounts - A BANK worker with a gambling addiction who embezzled more than £12,000 from customers’ accounts has walked free from court after a judge gave him a suspended prison sentence. Sentencing Matthew Farr, 23, who gambled £85,000 away in a 15-month period leading up to his arrest, Judge Rupert Overbury said he had “exploited” his position with Santander bank to systematically steal money from customers’ accounts. “The harm caused by what you have done has not only caused financial loss but also an incalculable erosion of public confidence in the banking system which is particularly serious in these current economic times,” said the judge.

- 7/27/12: Kosovan central bank launches sting operation on unlicensed financial institutions - The Central Bank of the Republic of Kosovo (CBK) today (July 27) carried out surprise visits to two locations on suspicion of the conduct of unlicensed financial activity. The operation was approved by the executive board of the central bank shortly before the investigations were launched.

- 7/27/12: Traders’ assets frozen in CNOOC-Nexen deal - A federal court on Friday froze the assets of traders accused of trading on inside information ahead of a controversial bid by China’s state-run CNOOC for Canadian oil company Nexen Inc., U.S. securities regulators said. The Securities and Exchange Commission sought the action and said certain traders used accounts in Singapore and Hong Kong to reap more than $13 million in illegal profits by buying up Nexen shares ahead of the deal.

- 7/28/12: Two PNB staffers held for accepting Rs 1.8 crore in bribe - Mumbai, Jul 28 (PTI) Two employees of a nationalised bank were arrested by CBI for allegedly accepting a bribe of Rs 1.8 crore in lieu of official favour, the agency officials said today. Manibhushan, senior manager in the Regional Stationary Department Centre of the Punjab National Bank and asset recovery agent Mendiratta were apprehended from here yesterday while accepting the bribe of Rs 1.8 crore from a complainant.

Category

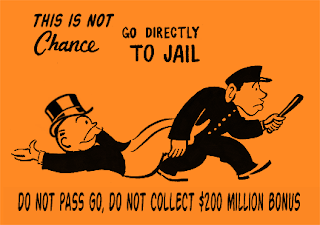

Not ONE of these has any

Not ONE of these has any impact on the real criminals, it's all just misdirection!

Are we awake yet!

This post shows the corruption

This post shows the corruption that has been going on around the world.It might only

show the small fish in the bigger ocean being caught,but the small fish are part of the bigger school too!!

The big fish will also be caught too so rather than comment on it as just being misdirection

why not focus on it as being something positive! (however small)

Love to you